1.0 Introduction

During the past decade, the world has experienced very difficult situation. Many countries have not yet recovered from the 2008 Global Financial Crisis. The Sino-US trade war poses threat on international trade (Brar, 2018, p22). The “Brexit” policy of the U.K. government further complicates the trade relationship between the U.K and EU countries. However, in order to overcome the above-mentioned political uncertainty and risk, and meanwhile address the domestic economic problems, the U.K. government has planned and implemented many macro economic policies such as fiscal and monetary policies. In fact, these government decisions do have a significant influence on the business decisions of companies in the UK. In this economic report, the current fiscal and monetary policies implemented by the UK government will be analyzed in details. Besides, how the business decisions of the AO World PLC is influenced by the government’s economic policies will also be explained. Last, recommendations will also be proposed to help AO World correspond accurately to the future impact of government’s economic policies.

2.0 Impact of recent decisions in both the monetary and fiscal policies of the U

2.1 Fiscal Policy of the U.K. Government

Fiscal policy involves changing the level of taxation and government spending to influence the rate of economic growth. In economics, the economic growth rate or real GDP growth rate (Y) = C + I + G + (X - M). In the formula above, G stands for government expenditure. The idea behind the fiscal policy is to increase the government expenditure so as to increase the overall consumption of goods and services (Arestis & Sawyer, 2010, p327).

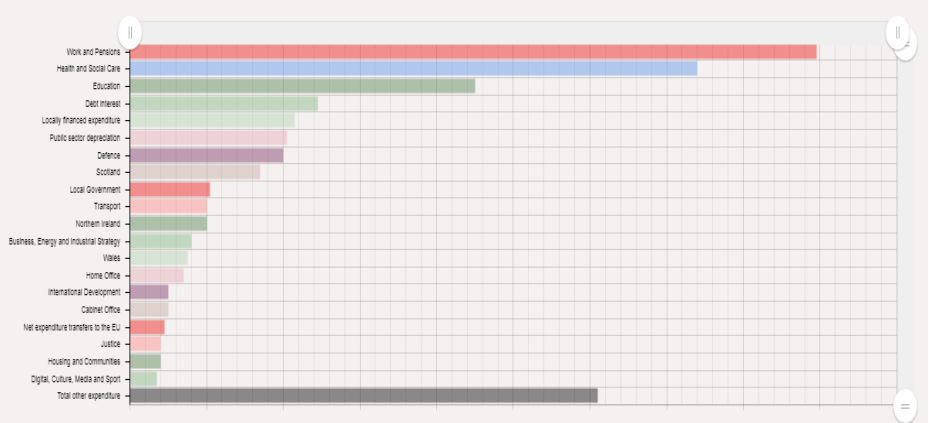

First, in terms of government spending, majority of the government expenditure is on work and pension (Economics Online, 2020, para 6). During the devastating effect of global financial crisis and the ongoing global pandemic, most UK residents are concerned about work and pension, and health and social care. It is also the major reason why most of the government spending is on these areas. In fact, it is a tangibly fact that the U.K. is going to leave the European Union. As a result, it is expected that more and more exporting activities may be adversely affected. The EU member countries may increase the tariffs on the British goods and services. As a result, it will be costly for the British products to be sold in the EU market. Inevitably, the British business owners have to lay off employees to reduce production cost (Economics Online, 2020, para 6). As a result, more and more British people especially the retired employees are worried about their pensions. In fact, due to the global financial crisis and the Covid-19, it is also expected that the demand of goods and services in both domestic and global market will keep dropping. As a result, the demand of British goods in both the local and global markets will drop as well (Coenen, Straub & Trabandt, 2012, p71). The British government has to take the responsibility to provide sufficient financial assistance to the vulnerable groups in terms of pension and social care. Additionally, many people cannot afford the medical treatment when they are tested positive for Covid-19. The British government has to increase the expenditure on subsidizing the medical treatment of Covid-19 and providing necessary medical supplies and equipment like ventilators for British citizens (Heald & Hodges, 2020, p12).

Source Credit:Economics Online, 2020

Fig 1: Major Government Spending in the Past Five years in the U.K.

Moreover, in terms of government borrowing, it can be observed that the value keeps increasing since the start of 2008 (Della & Talani, 2011, p1). It is well known that 2008 is the year when the global financial crisis took place. The British government has to borrow a huge amount of money from both local and international financial institutions in terms of long-term and short-term bonds. However, when the government borrowing reaches a peak at 10% of the national GDP, the British Government made the decision to reduce the borrowing. However, When the Covid-19 took place last year, the current government decides to increase the borrowing to 9.1 percent of the country’s GDP. Like the aforementioned, the borrowed money are used to subsidize work and pensions, and health and social care, education, debt, etc.

Fig 2: General U.K. government net borrowing as % of GDP

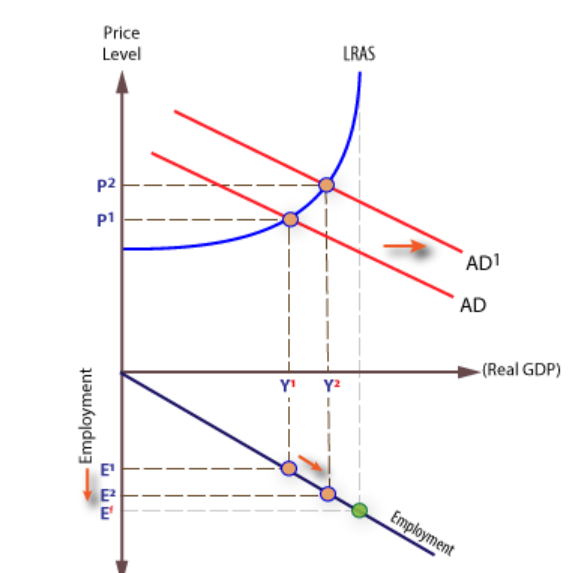

The effect of government expansionary has many advantages. For instance, government spending can shift the aggregate demand (AD) curve the right and offset the drop in demand in many other components such as consumption of capital goods or consumer goods (Garín, et al, 2019, p28). If the government expenditure is on capital goods such as infrastructure. On one hand, the local infrastructure can be significantly upgraded. For instance, there are many ongoing construction projects which are planned in the near future. Public spending can also be targeted to achieve a wide range of economic objectives such as job creation (Stockhammer, Qazizada& Gechert, 2019, p57). For instance, through financial public construction projects, more people can be recruited in the short term. The problem of cyclical unemployment can thus be resolved accordingly. On the other hand, through reducing the individual and corporate tax, local business owners have more incentives to retain their employees as the central and government government take parts of the increasing production costs. The effects of a expansionary fiscal stimulus on outputs and jobs can be shown in figure 3 below. When the aggregate demand curve shifts to the right, the net output can be increased from Y1 to Y2. Besides, the employment rate can be increased from E1 to E2.

Fig 3: Impact of Fiscal policy on economic development and growth

2.2 Monetary Policy of the U.K. Government

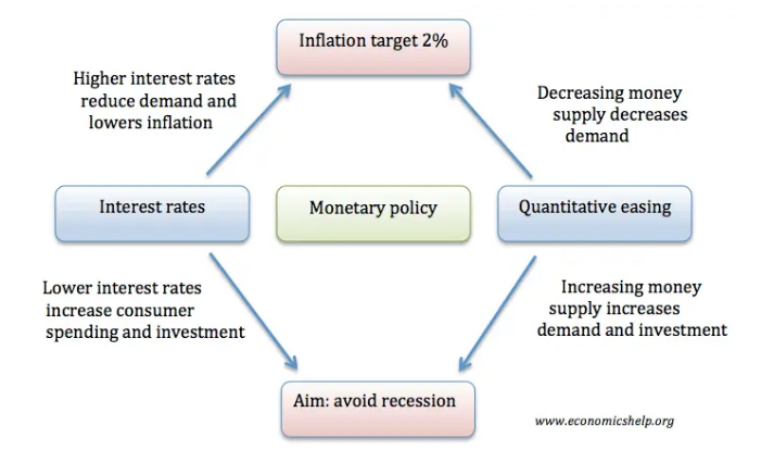

However, fiscal policy does not consider the impact of aggregate supply on the overall economic development. The Central Bank of the U.K., on behalf of the government, also uses monetary policies to address major economic problems in the country (Saunders, 2020). Monetary policy is action that a country’s central bank undertakes to use interest rates and other monetary tools to influence the levels of consumer spending and aggregate demand. For instance, if the U.K is facing a low inflation, the Central Bank will reduce interest rates to address the problem of economic recession. The reason behind this is not difficult. When the interest rate is low, individual consumers will find less incentives to save money in the bank. It is more likely for them to spend their money or invest in physical properties (Qureshi et al, 2019, p3112). Individual investors will also increase their investment as it is now cheaper for them to borrow money from the bank. The increase in investment (the “I” factor in the formula) will also increase the overall economic growth of a country. Lastly, local companies can also easily borrow money to finance their production activities and overcome difficult economic situation during a recession (Puri et al., 2020). Ultimately, this expansionary policy can reduce interests by increasing money supply in the financial market. Ultimately, both consumption and investment can be increased effectively.

Source Credit: Economics Help, 2020

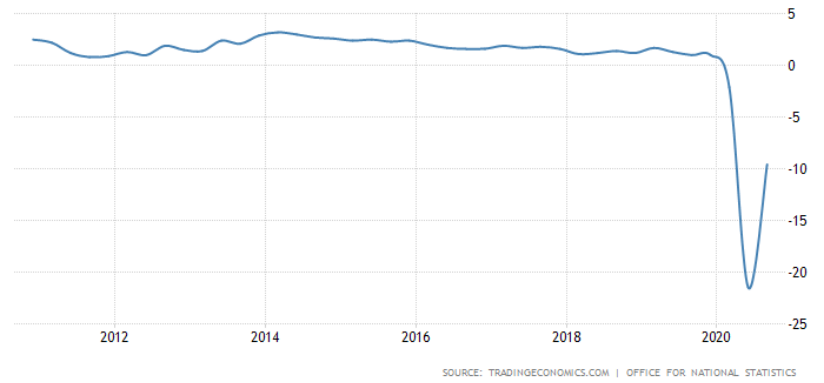

Fig 4: Mechanism of monetary policy in regulating a country’s economic development

However, like the aforementioned, the U.K. has not yet recovered from the 2008 global financial crisis. Besides, the future political uncertainties due to “Brexit” and the current outbreak of global pandemic further adversely affect the economic growth of the U.K (Hantzsche, Kara & Young, 2019, p5). As shown in figure 5 below, it can be observed that the economic growth of the UK keeps decreasing during the past decade. Even though the U.K. economy is gradually recovering, it is predicted that the annual GDP growth is -10% this year due to the devastating impact of Covid-19. As such, the Bank of England decides to implement an expansionary monetary policy, that is, to reduce the interest rates by increasing money supply in the financial market. The Bank of England, on behalf of the Monetary Policy Committee (MPC), decides to reduce the Bank rate by 50 basis points to 0.25% (Amaro, 2020). According to the MPC, the reason to significantly reduce the interest rate is to combat the corona-virus impact in the U.K. Like the aforementioned, the expansionary monetary policy can effectively increase domestic consumption and investment so as to increase the overall economic growth in the country.

Source Credit: Office of National Statistics of UK, 2020

Fig 5: United Kingdom GDP Annual Growth Rate during the Past Decade

3.0 Business Decisions of the AO World PLC as Being Impacted by Economic Policies

AO World PLC specializes in producing and selling washing machines, fridges, cookers, television sets, and other electric appliances in both U.K and European markets (Market Screener, 2020, para 1). The top management of the AO World believes that the political uncertainty between the U.K and other EU countries can significantly influence the company’s business decisions. Due to the worsening macro-environmental situation in the U.K and EU market due to political uncertainty of “Brexit” and the ongoing outbreak of Covid-19, it is expected that the net sales revenue and profits of AO World PLC will be negatively affected. However, like the aforementioned, the British government and the central bank of UK do manage to implement effective fiscal and monetary policy. Therefore, the business decisions of AO World PLC are readjusted according to the economic policies.

First, when the U.K. government implements an expansionary fiscal policy to borrow more money to boost domestic consumption and investment, the AO World PLC clearly captures the market signal. Due to the political uncertainty between the U.K and the EU, the supply chain of the AO World can be negatively affected (Market Screener, 2020, para 5). In the next decade, the focus of AO World will be more on the domestic consumption. Thus, the top management team of the company decides to increase the warehouse capacity to store more manufactured goods in the U.K. In case that the EU imposes higher tariffs on the UK commodities, AO World will be less impacted by the political turmoil of “Brexit”. AO also knows that the domestic consumption will increase due to government expenditure and subsidy on the aggregate demand. Hence, the company can anticipate the increase in domestic demand of goods and services.

Besides, like the aforementioned, the Bank of England, on behalf of the MPC, is implementing an expansionary monetary policy to lower interest rates. In other words, the cost of borrowing money in the financial market will drop as the money supply increases. Hence, the company can borrow money to finance its future business operations. For instance, AO World expects its German unit to become profitable in its 2022 financial year (Provan, 2020, para 12). In other words, the company decides to expand its business in Germany despite that the U.K. is leaving the EU.

4.0Future impact of Decisions Regarding Monetary and Fiscal policies

In fact, all small, medium and large companies in the U.K. can be significantly influenced by both fiscal and monetary policies of the U.K. when making key business decisions. It is expected that the process of “Brexit” is irreversible. Thus, it is predictable that the trade relationship between the U.K and other EU members will be negatively affected. In fact, the online electricals retailer, AO World, has already suffering from some supply train disruption at ports in the U.K. such as Felixstowe in eastern England (Market Screener, 2020, para 6). Besides, it is also foreseeable that the Covid-19 will not end in a short term. Therefore, business owners like AO World should carefully evaluate how fiscal and monetary policies can help it overcome potential trade and economic problems.

First, if the U.K government continues to implement expansionary fiscal policy, AO World should focus more on domestic market instead of the EU market. The central government implement more stimulus packages to boost domestic consumption of goods and services (Calcagno, P., & Hefner, 2018, p5). Besides, in order to help domestic firms overcome difficult economic situation, the U.K government may continue to reduce corporate taxes. The central government hopes that large companies like AO World will not retrench more employees. In fact, if companies like AO World decide to lay off employees to lower production costs, the disposable income of local residents will keep dropping. As a result, the demand goods and services will also drop accordingly. In economics, the situation is described as a “vicious cycle”. If the government makes the decision to reduce corporate and provide financial assistance to companies to protect work and pensions, AO World should not lay off employees in return.

Moreover, if the central bank of the U.K. continues to keep a low interest rate, AO World should continue to borrow money from the local financial institutions to finance its business operations and activities. The top management team of the AO World has already reported that the company manages to achieve monthly profitability on core earning basis this year. The company also expects that all business operations in Germany can be profitable from full year 2022 (Market Screener, 2020, para 15). In fact, most British companies are facing remarkably high political uncertainties. Apart from the “Brexit”, the Sino-US trade war will continue harming the global supply chain (Bunn, Pugh & Yeates, 2018). It is often difficult for Business owners to take side between China and the U.S when it comes to international trade. However, if the central Bank or MPC continues to maintain a low interest rate, companies like AO World should continue to borrow money and expand its businesses in other markets. The only thing is that AO Word should be careful in selecting the future markets. India, for instance, is a country with a huge population and market potential. AO World should expand its businesses in these emerging market economies.

5.0 Conclusion

In conclusion, fiscal and monetary policies of a government can significantly influence the business decisions of companies and organizations. Currently, the U.K government is implementing expansionary fiscal and monetary policy. On one hand, the U.K is trying to borrow more money from local and international financial institutions to boost domestic consumption and investment. It also implements tax reduction to help individual citizens and companies overcome difficult economic situation. On the other hand, the Bank of England decides to lower its interest through increasing money supply in the financial market. Through lowering interest rate, the cost of borrowing will be reduced significantly. In other words, more individual investors will invest their money on physical properties. But most importantly, the cost of borrowing money for companies like AO World will also drop. As a result, AO World can borrow money to finance its production and business operations.

Reference

Amaro, S.(2020). Bank of England cuts rates in emergency move to combat coronavirus impact. CNBC. Retrieved from:

https://www.cnbc.com/2020/03/11/bank-of-england-cuts-main-interest-rate.html

Arestis, P., & Sawyer, M. (2010). The return of fiscal policy. Journal of Post Keynesian Economics, 32(3), 327-346.

Bank of England. (2020). Monetary policy. Retrieved from:https://www.bankofengland.co.uk/monetary-policy

Brar, J. (2018). Factors in the Eruption and Persistence of Sino-US Trade War. Sino-US Trade War: A New Challenge to Globalisation, 22.

Bunn, P., Pugh, A., & Yeates, C. (2018). The distributional impact of monetary policy easing in the UK between 2008 and 2014 (No. 720). Bank of England.

Coenen, G., Straub, R., & Trabandt, M. (2012). Fiscal policy and the great recession in the euro area. American Economic Review, 102(3), 71-76.

Calcagno, P., & Hefner, F. L. (2018). Targeted economic incentives: An analysis of state fiscal policy and regulatory conditions.

Della Posta, P., & Talani, L. S. (Eds.). (2011). Europe and the financial crisis. London: Palgrave Macmillan.

Economics Online. (2020). Fiscal Policy of the U.K . Government. Retrieved from:https://www.economicsonline.co.uk/Managing_the_economy/Fiscal_policy.html

Garín, J., Lester, R., Sims, E., & Wolff, J. (2019). Without looking closer, it may seem cheap: Low interest rates and government borrowing. Economics Letters, 180, 28-32.

Hantzsche, A., Kara, A., & Young, G. (2019). The economic effects of the UK government's proposed Brexit deal. The World Economy, 42(1), 5-20.

Heald, D., & Hodges, R. (2020). The accounting, budgeting and fiscal impact of COVID-19 on the United Kingdom. Journal of Public Budgeting, Accounting & Financial Management.

Office for National Statistics. (2020). United Kingdom GDP Annual Growth Rate. Tradingeconomics. Retrieved from:https://tradingeconomics.com/united-kingdom/gdp-growth-annual

Provan, S. (2020). AO World swings to profit during pandemic ecommerce boom. Financial Times. Retrieved from:https://www.ft.com/content/019cfd9c-cee4-4620-8422-de12c67966f4

Qureshi, F., Khan, H. H., Rehman, I. U., Qureshi, S., & Ghafoor, A. (2019). The Effect of Monetary and Fiscal Policy on Bond Mutual Funds and Stock Market: An International Comparison. Emerging Markets Finance and Trade, 55(13), 3112-3130.

Puri, N., Maskell, J., Reid, M., Snagg, F., Morgan-Davies, B., Skinner, E., & Moorhouse, G. (2020). COVID-19: UK Government’s Latest Measures to Support Businesses.

Saunders, M. (2020). Covid-19 and monetary policy.

Stockhammer, E., Qazizada, W., & Gechert, S. (2019). Demand effects of fiscal policy since 2008. Review of Keynesian Economics, 7(1), 57-74.

Market Screener. (2020). AO World : Anticipating Brexit disruption, AO World doubles warehouse capacity. Retrieved from: