1.0 Introduction

Every company has its own original ideas, knowledge, innovation projects and creations. From the resource-based view, all of the above-mentioned are a form of intangible assets which can further be developed into a company’s core competencies as compared with other major competitors in a target market. Currently there are two major literature review methods, namely systematic literature review and narrative literature review. Broadly speaking, a systematic literature review is a review that collects multiple research studies and summarizes them to answer a very specific research question. A narrative literature review, on the other hand, is a comprehensive and objective analysis of the current knowledge in regards to a specific topic. In this study, narrative literature review method will be used to critically review the previous studies in regards to intellectual property right (IPR) and verify implications of intellectual property management to practicing managers and policy-makers. Moreover, the implications of international intellectual property management for further research will also be discussed in details.

A narrative literature review (NR) as compared with a systematic review has an advantage of high time-efficiency. It is often time-consuming to conduct a systematic review because it involves a very complicated process of identifying relevant researches, systematically critiquing research reports, synthesizing findings and interpreting research significance regarding one specific research topic. NRs do not only go deeply into the selected literature. One of the major purpose of NRs is to identify and summarize previous literature so that the problem of duplication can be effectively avoided. Through time-efficiently reviewing previous studies, researchers should be able to tract the progress of a certain field and identify research gaps.

Besides, NRs can address more than one research questions. Onwuegbuzie and Frels (2016) defined four common types of narrative reviews including general literature review, theoretical literature review, methodological literature review and historical literature review. General literature review, for instance, can provide a review of the most important and critical aspects of the current knowledge of a particular topic. Target audiences of the literature review can easily be explained about important concepts and terms regarding the topic. Historical literature review, on the other hand, focuses on examining research throughout a period of time. It helps researchers trace the evolution and progress within the scholarship of a discipline. As such, researchers are able to identify research novelties in their studies.

However, one potential problem is that NRs often lacks very clear reasons for why studies are selected in the literature review. The quality of the selected studies are often compromised as a result. Researchers tend to review many previous studies but do not consider the quality or potential biases in the study design. For instance, the number of qualitative studies might be higher than quantitative studies or empirical studies. But in reality, the selected studies may direct to different conclusions. It may generate a lot of confusions in the review.

The narrative literature review is chosen because the intellectual property is a very broad topic. Within this field, technology transfer, intellectual property right, intellectual property management, relationship between intellectual property and foreign direct investment, etc, should all be discussed. As such, systematic literature review tend to be less effective as it only deals with a very specific research topic.

2.0 Outline of the Topic and Research Significance

The objective of this literature Review is to critically review the literature in regards to technology transfer, intellectual property management and the role of technology transfer office in IPM. The research result can be used to guide the decision-making process of business owners and top management team of an international MNCs or SMEs with respect to technology transfer and intellectual property management when entering a foreign market.

China, for instance, is so far the largest and most thriving market in the world. Due to its huge population and rapid growth of the middle-class social group, most MNCs are very serious about doing business in this country(Awokuse and Yin, 2010). However, without adequate information about the local market like distribution channel, it is often difficult for these foreign companies to research end consumers and promote their products and services in the local market. The Best Buy, for instance, is the worlds’ largest electronics distributor, failed miserably in China’s market. It left China in 2008. In certain industries, China’s government is promoting the localization of important technologies and technology integration. For instance, government subsidies are favoring local companies which own intellectual properties(Bardhan, 1997). The government procurement also favors local firms which successfully appropriate, imitate, and incorporate foreign technologies. Therefore, foreign business owners should assess the risks associated with the technology transfer process before entering China’s market.

Besides, a large MNC like Apple Incs., has thousands of intellectual properties (Yang, 2014). The top management is often unclear whether other producers, competitors or business partners are violating their patents. From the resource-based view, intellectual properties are also an important intangible assent of a company. In other words, they should be managed very efficiently and effectively. The result of this research can thus be used to guide managers of a company about how to manage the IP portfolio and inventories.

Lastly, the technology transfer process for a company to legally transfer its technology to business partners such as joint venture is often complicated. It is very time-consuming for inventors to assess the risks associated with the technology transfer in a market with different national or cultural background. Besides, it is also very difficult for inventors to directly negotiate the terms and conditions in the technology transfer process. As such, it is important for business owners to know whether it is necessary to set up a unique division such as technology transfer office to monitor the whole process.

3.0 Critical Reflection on Methods

Unlike other research methods, a literature review is more about critically reviewing the previous literature and researchers with respect to a certain topic. The review of literature is a summary of all the reviews from various research literature related to the current research conducted by the researcher. Literature review can provide a guidance for a researcher to identify what has already been known and what more has to be done. Snyder (2019) found that literature review has to be included in research data because it can significantly influence the research result and findings of current study. Hopia et al.,(2016) further discovers that literature review is an account of what has been published by accredited scholars and researchers. For instance, in this study, the objective is to evaluate previous studies about the international intellectual property management.

The literature review research methodology has both pros and cons. One potential advantage of literature review is that it helps a researcher to discover research gap or novelty in a certain field (Hopia et al., 2016) . In fact, most researchers will describe research limitations and future directions in their papers. New researchers can effectively discover what has not been done and thus proceed with their own researches. Besides, through conducting literature review, a researcher can also identify important definitions of key terms or find theoretical framework to support their own studies.

However, one potential drawback of literature methodology is that literature review does not display advanced theories or discoveries. It is more about examining previous studies. Sometimes other researchers and scholars may make different or contradictory conclusions in their studies(Hopia et al., 2016). It will mislead new researchers in their own academic researches. For instance, with respect to intellectual property management, some researchers point out that strict intellectual property right protection will promote innovation. But some researchers believe that IPR protection will hinder innovation because innovators will find no incentives to develop new technologies or products.

4.0 Literature Review

4.1 Key Definitions and Terms

4.1.1 Intangible Assets and intellectual Properties

A company or an organizational can have both tangible and intangible properties. In law, anything can be touched including both personal property and real property can be defined as tangible property. For instance, office supplies, manufacturing machines and equipment, factories are all examples of tangible assets. But in some Common Wealth legal system, physical properties may still be considered as intangible properties such as documentary intangibles. A promissory notes, for instance, is a piece of paper that can be touched. But in fact it is an tangible property. By definition, intangible property or asset refers to properties without physical form. Usually there are two forms of intangible assents including legal intangible asset and competitive intangible asset.Intellectual property is a form of competitive intangible asset. The ownership of intangible property gives the owner a set of legally enforceable rights over reproduction of personal property containing contents like knowledge. For instance, a copyright owner can control the reproduction of the work forming the copyright.

Intellectual property refers to the creation of the mind including innovation, literary and artistic work, symbols, names, images, etc. Innovation, on the other hand, is a process through which economic or social value can be created or extracted from existing knowledge. Through creating, diffusing or transforming ideals, innovators can produce new products or enhance production processes. Patent, trademark, trade secret, and industrial design are all examples of intellectual property.

4.2 Intellectual Property Right and its Impact on Country-level Competency

Papageorgiadis et al., (2020) found that the enforcement of intellectual property right (IPR) has a positive impact on country-level competency such as outward FDI. The group of researchers manage to conduct a quantitative research on examining the outflow FDI of the U.S to 42 host countries. Thus, the research result is high credible and trustworthy. For the past few decades, many countries in the world especially developing countries look for foreign direct investment in order to boost domestic economic growth. FDI can directly promote job creating in the local market and meanwhile bring economic prosperity to the host countries. Intellectual property right, like the aforementioned, refers to the innovation or creation of the mind. Papageorgiadis et al., (2020) point out that outflow FDI is positively correlated with the strength of IPR protection in a host country. In other words, investors will opt to invest in a country in which their IPs can be protected very well. Host countries with higher IPR protection can also encourage the technology transfer and benefit local firms very well. Frandsen (2015) also points out that investors or inventors prefer countries with stronger IPR protection because their inventions are free from limitations.

However, Mahlich (2010) found that patenting or strict intellectual management may be negative correlated with business performance of certain industries. Mahlich (2010) made a close observation on the pharmaceutical industry. He observed that most Japanese pharmaceutical companies stopped investing on developing new products after obtaining patents. Artz, et al. (2010) on the other hand had conducted a longitudinal study over 272 firms in 39 industries of the U.S over 19 years. They also observed a negative correlation between patenting and sales growth. In fact, after receiving patents or IRP protection, most companies can generate a large amount of revenue through selling products based on patents. Besides, they can also lend the patents to other companies and earn a portion of their sales revenue. It is usually very costly to invest in developing or innovating new products. As such, it is expected that the sales growth will be negatively proportionate to patenting.

4.3 Impact of Intellectual Property on corporate-level competency

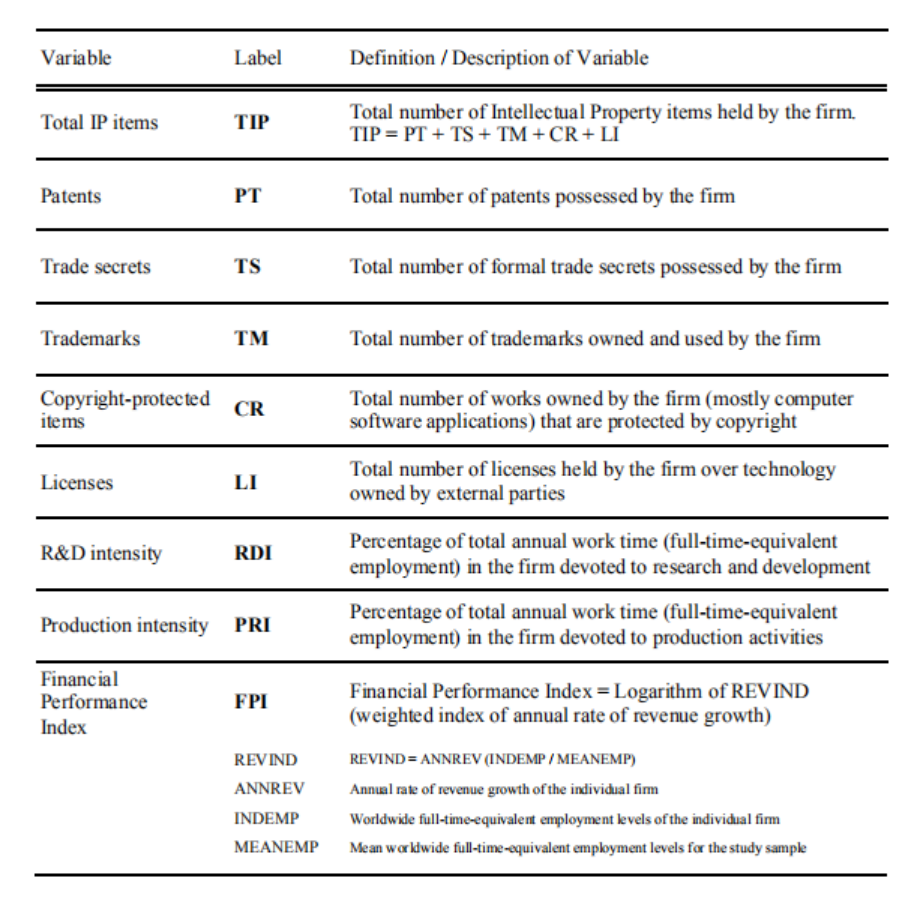

At a corporate level, Kevin (2013) reported a positive correlation between intellectual property protection and companies’ sales performance particularly in the bioscience-technology industry. The quantitative data were cited from previous papers. The intellectual property management and financial performance indicators are listed as follows,

Source Credit: Kevin, 2013

Fig 1: Key variables in the regression analysis

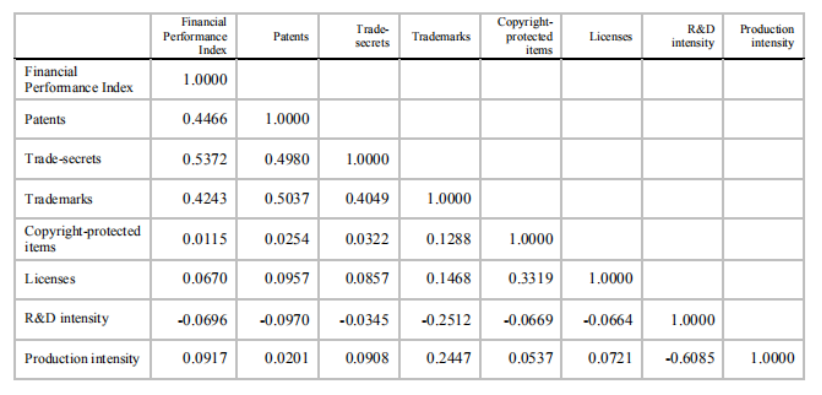

Through analyzing the secondary data with an OLS analysis, Kevin managed to derive a correlation matrix as follows,

Table 1: Correlation Matrix

Source Credit: Kevin, 2013

Kevin has made a very interesting observations of the impact of various intellectual properties on the overall financial performance of companies in the bioscience-technology industry. Firstly, financial performance of a company is strongly correlated with patents, trade-secretes, trade marks, production intensity. In fact, the result is coherent with previous studies. When a company has a large number of patents, it can earn a significant amount of profits from other companies who rent the patents. Through strict IPR protection, other major competitors will be barred from using the patents. It will create a competitive advantage of the company in a target market. Trade secrets also work the same way. The trade secret is often unknown to other major competitors. It allows a firm to take an advantage of asymmetric market information such as users’ buying preferences. It thus can lead to a higher profit for a company. However, as shown in the table, the financial performance is weakly correlated with copyright-protected items and number of licenses. However, copy-right protected items and licenses actually mean that a company will borrow technologies or patents from external parties. Each year, a company has to pay external parties for the license and copyrights. It will eventually drive up the total cost of production. Last, the financial performance is negative correlated with R&D intensity. It shows that companies have to pay a much higher price on developing new products or technologies. It often takes years for a company to offset the R&D investment through selling products or services.

4.4 Intellectual property, Innovation and Business Success

4.4.1 Intellectual Property Management and Innovation

A substantial focus of previous literature directs to the relationship between intellectual property management and innovation (Cincera, 1997; Cohen, et al., 2007; Lynskey, 2009). Some researchers describe intellectual property as a key determinant of business performance and innovation. Mann and Sager (2007) had conducted an empirical study on the relationship between the patenting behavior of particularly start-up companies in the venture capital cycle. The researchers managed to discover the relationship between patenting practices and performance data.

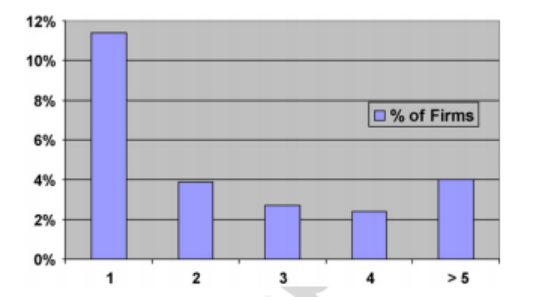

The first important finding is that among all the 877 investigated start-up software companies by 2005, only 24% (214/877) had managed to obtain patents. The venture capital cycle period is about 5 to 8 years. The results can be depicted in the Fig 2 below,

Source Credit: Mann and Sager, 2007

Fig 2: No. Of patents per start-up firm during the venture capital cycle

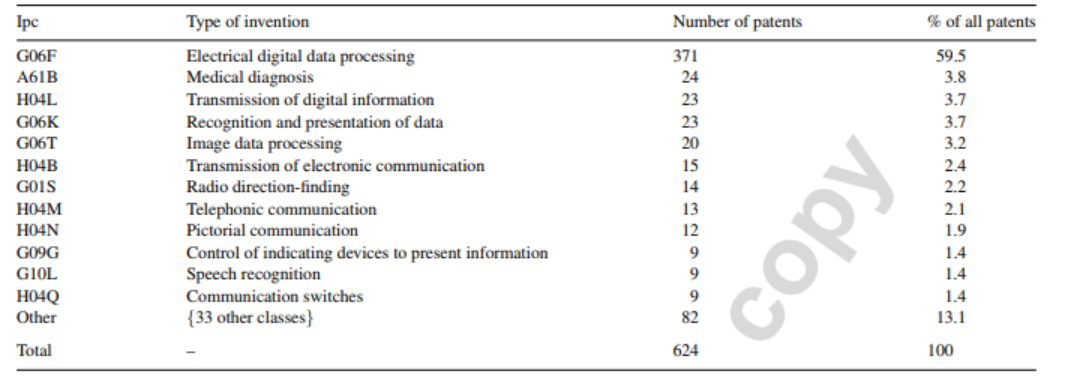

For comparative purpose, Mann and Sager (2007) also cited secondary data from Internet Patent Class in the bio-science industry as shown in table 2 below. The result is coherent with the researchers’ empirical study. It shows that a company’s business performance and innovation are weakly correlated with patents. The result is very useful in this literature review. Previous, it is assumed that innovative process is strongly related to the number of patents. It is because patents can reflect the researching ability and resources of a company. However, during the venture capital cycle, Mann and Sager proved that successful start-up companies do not rely on intellectual properties. There is only 0.71 patent per venture-backed start-up firm.

Table 2: International Patent Class

4.1 Foreign Direct Investment and Technology Transfer

A technology can be defined as knowledge and information that adjust and process selected inputs to achieve a certain production outcome (Maskus, 2004). Maskus (2004) also stated that technology can be both codified and uncodified. Examples of codified technology may include formula, blueprints, applications, etc. Uncodified technology contains tacit and uncodified knowledge such as capital equipment and financial tools. As compared with codified technology, uncodified knowledge can be easily imitated or copied by competitors. Products like financial tools and pharmaceutical recipes can easily copied. As such, it is important for companies and government authorities to pay special attention on the IPM of both codified and uncodified technologies.

However, Maskus failed to found that in a real-world scenario, technology transfer always takes place. Very often technology takes place in both market and non-market based mechanisms. Market-based mechanism may include joint venture, foreign direct investment, syndication, international trade, cross-border movement, etc. Non- market based mechanism means that technology may not be transferred based on a simple demand and supply mechanism. For instance, sometimes when an employee leaves his or her position, he or she may legally or illegally transfer the intellectual properties to another company. Maskus’ discovery is highly insightful. It recognizes technology as a kind of intangible asset. It should be noticed that assets can be used to create value for all stakeholders. It can be transferred into a company’s core competencies and sustainable competitive advantages.

Costa (2002) discovered that the import of capital goods, technological skills and patents, can directly enhance the productivity of production operations and activities. Cost (2002) conducted researches among 100 companies in China. He found that most Chinese companies rely on foreign direct investment (FDI) in the process of technology transfer or acquiring new technology from the owners. Under a well-organized intellectual property management system (IPMS), companies have to obtain licenses from the owners in regards to the production and distribution rights. Licenses may also be applicable to the companies’ subsidiaries or other unrelated firms in a joint venture. Costa’s research is highly meaningful. It shows that intellectual property management is closely related to FDI inflow. On one hand, local companies usually lack of important technologies. But on the other hand, local companies can have a much easier access to the local market. With effective intellectual property management and strong IPR regulation, it is expected that investors will be more confident on the rate of returns collected from the local firm. Most importantly, multinational Corporations may retain the control of their intellectual property rights in the intra-firm licensing. But it is often difficult for MNCs to influence the technology transfer process in unrelated firms such as joint venture. Joint venture are arrangements among two or more firms when doing business in a target market. The role of MNCs in a joint venture is about providing technologies, skills, knowledge and other intellectual properties. Local firms, on the other hand, provide distribution network, customer data, brand recognition, marketing resources and channels.

But Edwin(1995) found that in the technology transfer process, the movement of organizational resources, skills, knowledge and human resources are often more restrictive and less flexible. The significance of Edwin’s research implies that the process of transferring technology is often strictly regulated. Otherwise, business secrets and other important intangible assets might be leaked to other competitors or unauthorized parties. It will result in huge economic loss for the owners of intellectual property rights.

Branstetter et al., (2002) found that foreign direct investment among all channels of technology transfer is very popular among international SMEs and MNCs. By definition, foreign direct investment refers to the act of establishing or acquiring a foreign firm or subsidiary through providing investment. Meanwhile, investors will also have substantial management control over these firms or subsidiaries. The observations of the researchers are very important for us to understand the role of intellectual property management and technology transfer in international trade. Large investors like MNCs either have technology or capital or both. In order to enter a foreign market, MNCs requires distribution channels, social network , brand recognition, users data, and other production inputs. Therefore, it becomes important for them to collaborate with local firms in production operations and activities. Local firms also need the FDI financing and technology to support various production activities .

However, the relationship among FDI, intellectual property management and technology transfer process are quite complicated. According to the research of Keith et la.,(2002), a foreign company can enter a local market with following methods 1) direct export, 2) providing FDI and controlling the production process, 3) licensing, 4) joint venture or joint venture syndication (Papageorgiadis et al., 2020). It should be noticed that both foreign investors or companies and local firms have their own advantages. First, companies can enter a foreign market through direct export. But it should be noticed that the direct export process is often costly for producers. The exported goods are often exerted with very high tariffs. The cost of production in terms of land cost, labor cost, cost of raw materials, etc, are often higher than those in developing countries. As a result, the products and services are often less price-competitive than products in the local market. Alternatively, foreign producers can provide FDI to local companies in exchange for management control in key business operations and activities(Lee, et al., 2018). FDI is a kind of equity financing method. Through obtaining the stock rights of a local company, foreign investors can exert a significant influence on the company’s business management strategies and decisions. Moreover, foreign companies can also provide licensing. In other words, these companies can license the production and distribution of local producers in exchange for a portion of the sales revenue. In return, foreign companies can provide the right of using parts of their intellectual property rights like technologies. Last, joint venture is a very popular option among foreign and local producers. In fact, when doing business in China, many foreign producers are either allured or forced to form a joint venture with local producers. BMW, for example, is a very reputable automotive producer. However, when it enters China’s market, it forms a joint venture with Huachen, a local automotive producer(Clegg and Voss, 2011). The two companies share important technologies and customer data when producing and selling Huachen-BMW automobile products. Currently, the headquarter of Huachen-BMW is located in Shenyang, the capital of Liao Ning province, China. The advantage of a joint venture is that a foreign company can have an easy access to cheap labor cost, electricity, target customer information, marketing materials and channels, raw materials in the local market. But at the same time, local companies can enjoy the brand recognition and technologies owned by the foreign company. Generally speaking, local producers have the so-called location advantages. Location advantages may include market size and growth, natural resources, trade protectionism policies, local infrastructure, government subsidies and low labor cost. Direct exports often work well when bilateral or multilateral trade takes place within a free-trade agreement (FTA) framework. For instance, OECD countries agree to lower the tariffs exerted on imported goods and protect intellect properties of member states. Smith (1999) found that without free trade agreement or other trade deals, foreign direct investment will be more suitable for foreign exporters. However, it is important to make sure that patent rights should be strengthened to protect the business interests from being harmed by imitation during the market expansion.

The impact of IPR on FDI is also subject to the market size(Awokuse and Yin, 2010). China, for instance, is now the world’s largest consumer market. It is also the largest trading partner of most countries in the world. Many multinational corporations eye for the huge sales revenue and profits generated each day in the China’s market. The requirement for strong and strict intellectual property right protection will be weakened if the profits are huge enough. Volkswagen or VW, for instance, shared its technology with YiQi group, in order to make an access to the local automobile market (Clegg and Voss, 2011). In return, VW has enjoyed huge increase in sales revenue. China is now VW’s largest overseas market.

The technology spillover may grow competitors for international MNCs as well. The experience of China demonstrates that the technological transfer between foreign and local companies can accelerate the catching-up process of the local industry. Allred and Park (2002) found that Original Equipment Manufacturing (OEM) model facilitates the technology transfer. Allred and Park (2002) observed that 76.5% of the researched companies prefer to the OEM model because it tremendously reduces the cost of production. It would become much cheaper to collaborate with OEM factories through transferring technologies and getting access to the local market.

Allred and Park’s research is very meaningful. It can be used to understand the role of technology transfer in OEM model. OEM is a specific form of sub-contracting which allows MNCs or TNCs to outsource parts for their production operations in the developing countries and ultimately market the products under their own brand name. In this process, the cost of production can be lowered because most of the final products are produced in the developing countries so that the producers can access the cheap labor and raw materials in the local market. But in the OEM process, MNCs or TNCs helped in selection of capital equipment, advised the production process, provided technological guidance and supports, enhanced the overall organizational management efficiency, etc. As a result, local producers can also benefit from the experiences and technologies of international MNCs. At present, parts of OEM business overlaps with ODM (own design manufacturing). OEM and ODM producers carry out most of the design tasks and production operations based on the layout provided by the Partner MNC. Foxconn, for instance, is both an ODM and an OEM partner of Apple, Inc., the worlds’ largest Smart Phone producer. Under well-organized and protected IPR, the foreign MNC and local Foxconn have enjoyed tremendously business success in both China’s and global market.

4.2 Intellectual Property Rights and Technology Transfer

According to Glass et al., (2007) knowledge and technology is a public good that has the characteristics of non-rivalry and non-excludable. In other words, when knowledge or technology is shared among different users and competitors, the products and services produced will turn against the innovators and harm their interests. It will result in a market failure situation. As such, governments have to protect the intellectual property rights of innovators or compensate the innovation in terms of subsidies. Intellectual Property Rights or IPRs are a government-protected right which prevents others from using the technology or knowledge within a certain period of time so as to protect the innovators’ interests. Through protecting the IPRs, it will temporarily offer a monopolistic power to the innovator. For instance, before the emergence of Mac OS, the Windows operating system developed by the Microsoft company dominated the global market for nearly three decades. Microsoft has enjoyed billions of dollars sales revenue from selling the Windows OS to the global market. When innovators learn that their intellectual properties can be well protected, they will be more motivated and incentivized to develop creative and innovative products due to the huge profit margins behind.

In this way, IPR also plays an important role in technology transfer. Mansfield (1994) surveyed over 100 U.S companies about the impact of IPRs on the technology transfer process. The qualitative result showed that the technology transfer decision can be significantly influenced by the strength of IPRs. The study unraveled that 65% of pharmaceutical companies will not consider a technology transfer without patenting. Over half of the surveyed participants from the top management team of the selected companies believed that a good intellectual property management system (IPMS) can positively affect the company’s profits.

However, Du and Tao (2008) pointed out that strong IPRs is important but not the dominant factor in influencing technology transfer decision. The research stated that most local companies in the underdeveloped regions like East Africa do not have the ability to imitate or illegally copy technologies from MNCs, in other words, have strong IPRs. But these countries are not the top destination for technology transfer and foreign direct investment of MNCs. Market potential, political stability, high-skilled labor, etc , should all be taken into consideration when MNCs are making decisions in transferring technology. Japan, South Korea, Taiwan, are all popular destinations for technology transfer and foreign direction investment. Henisz (2000) pointed out that Japan initially does not have a very good IPRs protection. The government before 2000 even encouraged adaptive innovation and imitation in order to upgrade the local supply chain and industries. But lately, due to the pressure of U.S government, the Ministry of Trade and Industry (MITI) was forced to implement technology licensing regulations to stop illegal technological imitation and technology theft in 1993. From then on, the foreign direction investment and technology transfer from the U.S to Japan almost doubled. When Japan successful upgraded most of its industries such as automotive industry, semi-conductor industry, electronics industry, etc, the local government started to discourage FDI as a form of financing method. Instead, the Japanese government is using the IPR protection system to encourage local companies to incorporate and assimilate the imported technologies from the U.S and other developed countries. The so-called “integration strategy” effectively bring the resources from local research centers, universities, private sectors together to resolve important design and production problems. As compared with other developed countries, Japanese government is practicing a “decentralized management” strategy in managing the intellectual property rights. In other words, the government plays a weaker role in the process of technology transfer. The whole process is more influenced by a demand-and-supply market mechanism. The role of government is very much like a coordinator which coordinate resources together to support production innovation.

Glass (2002) found that strong and high IPRs standard might not always be a blessing to innovation. Glass (2002) had conducted a longitudinal empirical analysis on 212 technological companies. He discovered that strong IPRs discouraged innovation. The logic behind is simple. Global MNCs expect a slower loss of their IPR advantage so that they can gain higher profits per IP. However, once it becomes difficult for other major competitors to imitate their technologies, these MNCs will be less incentivized to develop new technologies or IPs due to the monopolistic power given by the IPR protection regulations. The high IRP protection standards slow the process of technology transfer and innovation. For instance, Bill Gates, the former founder and CEO of Microsoft admits that the blocking of patents discourage the company from innovating and developing new products. As a result, the company failed compete with Google in developing operating system for smart devices and lost a large amount of market shares to android.

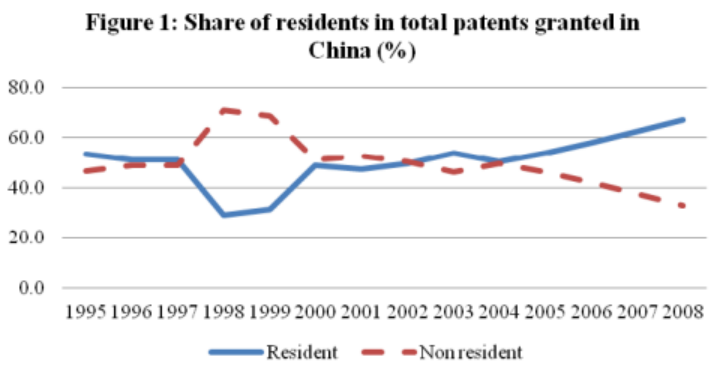

Last, local companies can also take advantage of government’s policies in developing their own products and businesses through technology transfer and technological innovationprocess. According to the study conducted by the United States International Trade Commission (USITC), China’s government policies did support the technology transfer, and local adaption of technologies mainly in 6 ways. First, local innovation projects are favored in provincial and central governments’ procurement. DJI droids, for instance, are supported by Shenzhen government, as part of its surveillance system. In return, DJI receives government subsidies and procurement order to finance its innovation and production activities. Second, China also has a different IPR protection standard, which smooths the process of acquiring or adapting foreign technologies when doing business. Third, China, as compared with the U.S, Japan and other developed countries, has very strict anti-monopoly law. It discourages local enterprises from taking advantage of their monopolistic power and stopping innovation investment. Fourth, China’s government is practicing forced technology transfer in particular industries. Like the aforementioned, in the local automotive market, if a foreign automobile producer like VW wants to enter China’s market, it has to transfer parts of its technology to a local automotive company in the form of joint venture. On one hand, it is true that foreign MNCs can enjoy cheaper cost of production and easier market entry. But on the other hand, such government policies breed the rapid development of local brands like Chery and BYD. After acquiring and adapting foreign technologies, local car producers take this opportunity to growth their own business and gradually replace foreign brands in the low and middle-end automotive market locally and globally. Fifth, the technology transfer from a foreign company to a local Chinese company is supported by tax exemption(Boisot, 2004). China’s government will impose a zero tax on the technology transfer if the technology is owned locally. Last, China’s central government also welcome foreign direct investment to finance local production operations and activities. Through implementing the above-mentioned measures, the technology transfer process has been accelerated very significantly in China’s market. It does not only protect the IPR of foreign and local producers but also promote innovation by weakening monopolistic power. According to the data published by WIPO data base, the share of residents intotal patents granted in China from 1998 to 2008 have increased by nearly 40%. it is expected that this number will be increased by another 20% by the end of 2020. at the same time, the patents granted for non-residents have dropped significantly in the past two decades.

Source Credit: WIP Database

5.0 Analysis and Critical Discussion

After critically reviewing the previous literature, it can be observed that intellectual property management is high critical for an international company to enjoy a business success in the global market. Two important observations have been made upond the literature review. First, foreign direct investment and government policies can exert an significant influence on the overall process of technology transfer and intellectual property management. Second, it is important for business owners to protect their own property rights through adopting IPMS system.

5.1 Risks in intellectual Property management for Bussiness owners and practicing managers

International MNCs should be cautious about the external factors which influence the technology transfer process. In the automotive industry, on one hand, foreign MNCs can take advantage of forming a joint venture with local companies. Through providing FDI or establishing joint venture, foreign companies can share the customer information, natural resources, land and labor, distribution networks with local producers(