Introduction

On 17th August 2018, the Governor of the Reserve Bank of Australia warned the threats of global uncertainties on Australia’s economy. In this report, the state of the economy, global tariff uncertainty, global financial market uncertainty and U.S economic activity uncertainly would be systematically discussed and evaluated in details.

State of the economy

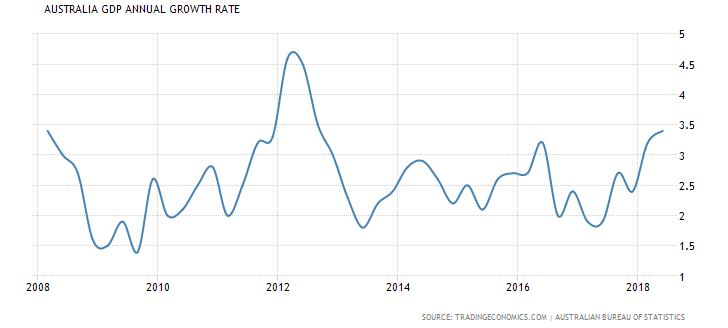

According to the report released by the Reserve Bank of Australia, the net GDP growth this year is 3.1%, relatively higher than the past few years. As shown in figure 1, the GDP annual growth in the past decade keeps fluctuating. However, from 2017 onward, it is in an upward trend. It shows that Australia’s economy is recovering.

Source Credit: Australian Bureau of Statistics(Tradingeconomics, 2018)

Fig 1: Australia GDP Annual Growth Rate

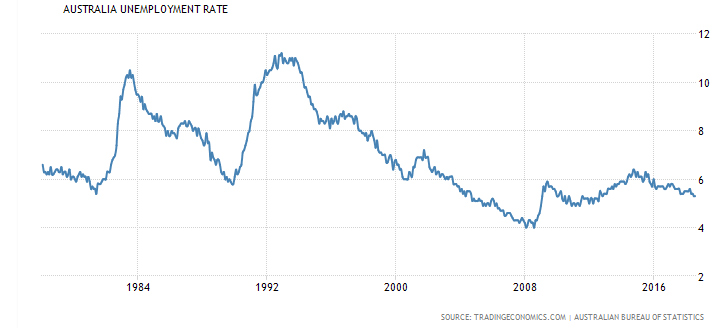

Moreover, the unemployment rate is also decreasing very significantly as shown in Fig 2. In 2018, the unemployment rate is reported to be 5.5% according to the governor’s report. It shows that the problem of cyclical unemployment is very much alleviated. Originally due to the global financial crisis, the demand of manpower in the job market is very much reduced. It results that huge number of Australian employees were laying off. However, when Australia’s economy is recovering, the demand of manpower would be restored. However, due to rapid technological development, labor skills in Australia might not match the expectation of employers. It would further lead to structural unemployment. The economic growth could not address this structural unemployment problem.

Source credit: Australian Bureau of Statistics(Tradingeconomics, 2018)

Fig 2: Australia Unemployment rate

In addition, according to the report published by the Reserve Bank of Australia, the inflation rate in 2018 is about 2%. As shown in Fig 3, the inflation rate in the past decade is in a decreasing trend. It shows that the cost of living in Australia is generally decreasing. Low inflation provides economic stability. It would encourage firms to become optimistic about the local market and more than willing to invest. It might be true that high inflation rate is associated with inflationary economic growth but it is rather unsustainable. In another words, low inflation rate would allow Australia to prevent boom and bust economic cycle.

Source credit: Australian Bureau of Statistics(Tradingeconomics, 2018)

Fig 3: Australian Inflation Rate

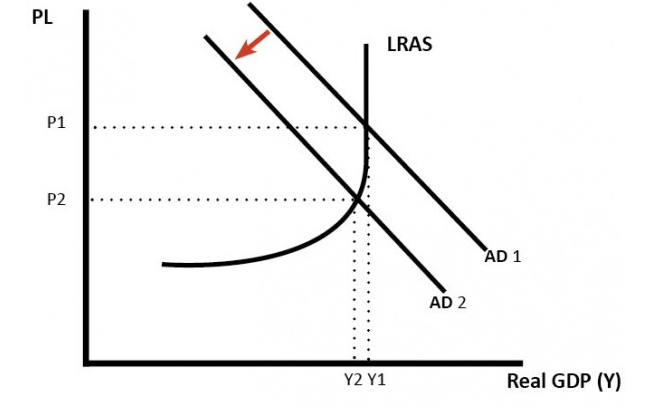

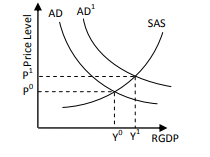

However, based on AD/AS analysis, to achieve low inflation might lead to economic problem as shown in the diagram below, the real GDP of Australia would expect to drop as a consequence if the LRAS is assumed unchanged. The fall in general price level would lead the Aggregate demand curve to shift left. The national out would decrease from Y1 to Y2. But from monetarists’ viewpoint, the LRAS is inelastic. It means that the target of low inflation would contradict with other macroeconomic objectives. The fall in real GDP would just be temporary. In the long run, it would restore to the full employment point of national output.

Fig 4: problem of low inflation rate

Global Tariff Uncertainty

According to the governor’s report, it is indisputable that the trade tensions and protectionism are getting more and more severe recently. Before these trade tensions, the global trade growth is in an increasing trend as shown in fig 5. However, from 2015 onwards, more and more countries such as the U.S are trying to impose tariffs on imports to protect domestic industries(Bourlioufas, 2017)ising of trade protectionism would generate a lot of uncertainties especially for trade-dependent countries.

Source Credit: World Bank/OECD (The World Bank, 2016)

Fig 5: Global trade growth pattern

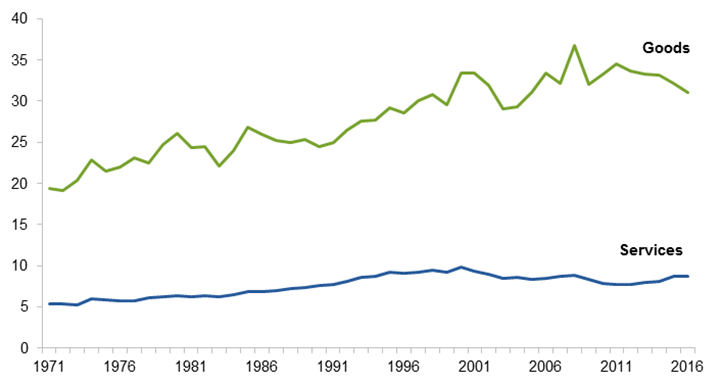

According to the report of Australian System of National Accounts, the trade’s share of Australia’s GDP has been increasing since 1971 as shown in Fig 6.

Source credit: ABS (Australian Bureau of Statistics, 2017)

Fig 6: Trade’s share of Australia’s GDP

According to AD/AS model, AD = C + I +G +(X –M). By definition, tariffs are taxes imposed on imports or exports. Increasing tariffs on imports for instance, would make them more expensive. As a result, people in a country would purchase the imported goods less. When the “M” factor is reduced, the net trade volume (X – M) would increase. It would result the aggregate demand shift to right as show in Fig 7. As such, the U.S, for instance, would enjoy an increase in terms of national output or real GDP.

Fig 7: Tariffs imposed on imports

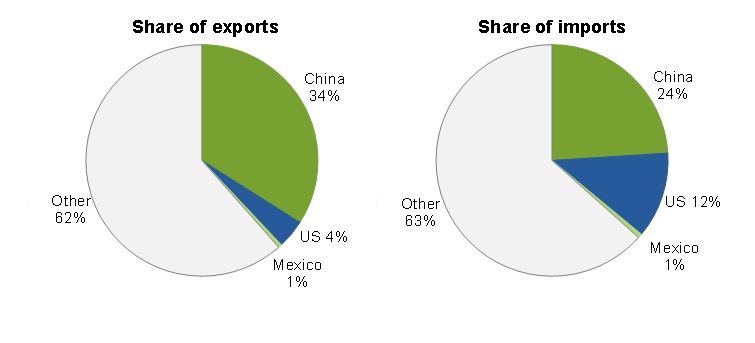

However, countries such as Australia are certainly trade-dependent. According to UN’s statistics, China and the U.S are the largest and second largest trading partner of Australia respectively. Over 34% of Australian exports goes to China and 4% goes to the U.S. Meanwhile the imports of goods from China and the U.S are 24% and 12% percent respectively. Any tariffs on imports and exports would adversely affect Australian national output. As the X factor of Australia would go down due to increase in tariffs. Hence, the aggregate demand in Australia will shift to the left. It would result a decrease in national output.

Source Credit: UN

Fig 8: Share of exports and imports in Australia

In order to address this possible tariff uncertainty, the Australian Government is advised to employ a fiscal policy. Generally speaking, fiscal policy is a kind of macro-economic policy to influence the level of domestic economic activities through manipulation of government income and expenditure. As the aforementioned, tariff increase on Australian’s exports would result the aggregate demand shift to the left. Through increase government expenditure (G), the domestic consumption (C) and investment (I). For instance, government could spend money on social security, law and order, education, transport, agricultural and other public sectors. It would result the AD shift to the right in the short run. Meanwhile, government could reduce income tax to boost domestic consumption. Reduction in corporate tax would also provide investors incentives to invest in domestic economy. However, eventually the fiscal policies may drive up the inflationary pressures. In another words, the cost of living may increase as a result.

Global Financial Market Uncertainty

According to the report of the Reserve Bank of Australia, many countries in the world are facing the financial problem of market volatility. Generally speaking, the problem of worsening global “credit crunch” would lead to deterioration of global financial system. It will further lead to fears of global recession. Ultimately, the general price level would go up even higher. It will continue to worsen the problem of global “credit crunch”. It is very much like a vicious cycle. The rising global market volatility has seen the Australian share market fall over 35% in 2017. Meanwhile, global market volatility is only affecting Australian’s share market. S&P500 in the U.S drops by 24%. FTSE in UK drops by 23.2%. DJ Euro Stoxx 50 drops by 30%. Market volatility is expected to continue in the next following years. Most asset classes are reported to have negative returns. Generally speaking, the global financial market uncertainty implies that the global economic growth would continue to slow down. Economic recession would not terminate in the short run. However, as shown in fig 8, Australia still maintains good trade relationship with U.S, China, India and some other emerging markets. The economic outlook as a whole is slightly positive. Besides, Australia government surplus and the ongoing demand of Australian commodities would allow the long-term returns in Australian shares to remain robust.

Under such context, it is more advisable for Australia government to employ a monetary policy corresponding to global market volatility. Generally speaking, monetary policy aims to influence the level of economic activities through changes amount of money in circulation and the price of money. When Australian government’s central bank lowers the interest rate. The cost of borrowing would be much cheaper. It would allow individual consumers to apply more credits or loans. Ultimately the consumption of goods and services are going to increase. Very similarly, through interest rate transmission mechanism, firms could also apply corporate loan more easily. It would promote investment accordingly. Hence, the aggregated demand would shift to the right as C and I factor are increasing. The national output would increase as well. It will also help to stabilize local financial institutions.

U.S Economic Activity Uncertainty

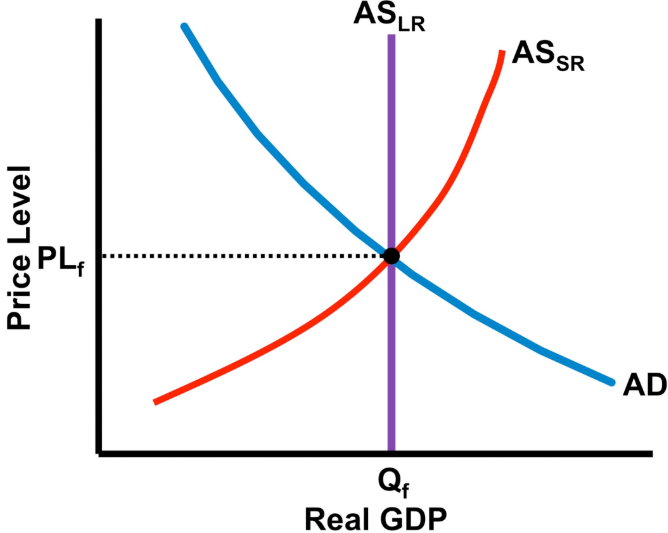

Another major concern is that U.S economy has already been at fully employment level but the Trump’s administration still insist to create excessive fiscal stimulus to the U.S economy. To economists, full employment does not mean zero unemployment but the unemployment rate has been reduced to the lowest possible value. As shown in fig 9, full employment would be achieved when short run AS, long run AS and AD curve intersect at the same point. At the full employment level, additional fiscal stimulus would not generate any new jobs, new investment, or higher real income(Bivens, J and Zipperer, 2017). So far, when Trump held in office, he tried to imposed import tariffs, reduce domestic corporate taxes, and promote domestic economic activities”. However, as the aforementioned, the expansionary fiscal policy will not create additional jobs and investment but will result in overheating. It is true that Trump’s fiscal policy to lower corporate tax and income tax would benefit U.S-based firms and families in the short run. However, as U.S is already at full-employment level, fiscal stimulus may open up for a huge government deficit. Remember that the U.S has already been in a great debt burden.( Bivens and Zipperer, 2017). In addition, when the AD curve is shift to the left, it would create huge inflationary pressure. The U.S government, or Federal reserve might have to employ monetary policy to counter the increase in inflation. A possible consequence is that the U.S currency would depreciate.

As such, it is expected that the U.S companies would be more competitive in the global market due to their unfair advantage in terms of currency(Lachman, 2016). Their exports would be more competitive in Australia’s market. As shown in fig 8, 12% of Australian net imports com from the U.S. The profits of local industries would be negatively affected. Therefore, it is more advisable for Australia government to employ fiscal policy as well. Through reducing the corporate tax of local companies, investors would have more incentives to invest in local market. It would shift the aggregate demand curve to the right. However, it is not advisable to employ monetary policy to depreciate Australian currency. It would negative affect the trade relationship with major Australian trading partners and perhaps the international trade relationship in the long run.

Fig 9: Full employment level in AS/AD model

Reference

ABS (Australian Bureau of Statistics) 2017, Labour Force, Australia, April 2017, Cat. no. 6202.0, ABS, Canberra

Bivens, J and Zipperer, B. 2017. The importance of locking in full employment for the long haul. Economic Policy Institute. Retrieved from: https://www.epi.org/publication/the-importance-of-locking-in-full-employment-for-the-long-haul/(accessed17 Oct 2018)

Bourlioufas, N.2018. Trade War Threat To Australia. FNarena. Retrieved from: https://www.fnarena.com/index.php/2018/07/06/trade-war-threat-to-australia (accessed17 Oct 2018)

Lachman, D. 2016. Does the U.S. really need a fiscal stimulus?AEI. Retrieved from: http://www.aei.org/publication/does-the-u-s-really-need-a-fiscal-stimulus/(accessed17 Oct 2018)

The World Bank. 2016. Tariff Rate, Applied, Weighted Mean, All Products (%), http://data.worldbank.org/indicator/TM.TAX.MRCH.WM.AR.ZS?locations=US (accessed17 Oct 2018).

Tradingeconomics.2018. Australia GDP Annual Growth Rate. Retrieved from: https://tradingeconomics.com/australia/gdp-growth-annual(accessed17 Oct 2018)

Tradingeconomics.2018. Australia Inflation rate. Retrieved from: https://tradingeconomics.com/australia/inflation-cpi(accessed17 Oct 2018)

Tradingeconomics.2018. Australia Unemployment rate. Retrieved from: https://tradingeconomics.com/australia/unemployment-rate(accessed17 Oct 2018)