I. Abstract

Goczek and Mycielska(2017) critically review the negative effect of low exchange rate volatility on bilateral, multilateral or international trade. Goczek and Mycielska (2017) point out that in order to promote monetary integration, removal of exchange rate risks would be highly demanding. In another words, the frequent fluctuations of exchange rates would certainly increase the trade cost under the floating exchange rates scheme. According to the survey conducted by NBP in 2011. Single currency often significantly removes the exchange rate risks associated with merchandized trade. It would also remarkably lower the cost of doing business. However, there are still very few meaningful researches to investigate the relationship between exchange rate volatility and trade. It is true that the relationship in fact is rather complicated. A significantly stronger currency would reduce export competitiveness but meanwhile it would make import cheaper. It would lead to a widening trade-deficit in the country. As a result, the currency would be deprecated due to a self-adjusting mechanism. However, according to this mechanism, it could be predicted that export-oriented industries would be devastatingly destroyed. The inter-relationship between exchange rate volatility and trade is very much like a feedback loop. Exchange rate would create a very significant impact on trade deficit or surplus but they will in return affect the exchange rate as well. The aim of this report is to verify whether the removal of risks associated with exchange rate volatility would promote trade activities among different countries.

II. Literature Review and Model

2.1 Gravity Model

Ozturk(2006) managed to observe that high exchange rate volatility would lead to a reduction in trade volume. The scenario behind is that high exchange rate volatility would remarkably increase the cost of doing business. In general, it would be rather difficult to predict the profit or expense during one transaction. In this sense, the bilateral or regional trade would be discouraged in this way. However, Goczek and Mycielska(2017) point out that the previous empirical researches imply that this impact of exchange rate volatility on trade is still ambiguous. According to the research conducted by McKenzie (1998), both positive and negative impact of high exchange rate volatility have been observed. He shows that the dominant factors are more closely associated with trader’s preferences, time zone, degree of market development and so on, instead of exchange rate factors. On one hand, McKenzie (1998) observes that high exchange rate would decrease the trade volume. On the other hand, increased volatility would force companies to increase exports to cover the decrease in revenue. This two outcome is solely depending on traders’ preferences for risk. In the case of high risk propensity, traders would be encouraged to do business under the increased volatility. It means that high volatility actually promotes trade activities. Moreover, Hall et al.(2010) shows that the high exchange rate volatility are more significant to small economies especially those which are heavily dependent on a large economy. however, emerging economies such as India, China, and so on, are not significantly impacted by high exchange rate volatility. Even though Hall et al. (2010) finds a negative impact of high volatility on trade in their research, the result is rather statistically insignificant as compared to other factors.

Baak (2006) has conducted a research to examine the impact of exchange rate volatility on trade among fourteen Asian Pacific countries. The model used in his research is called the gravity model. It would also be used as the theoretical model in this research,

Expijt*Expjit=β0+β1GDPit*GDPjt+β3VOLijt+β4DISTijt+β5BORDijt*GDPjt+β6LANGijt+β7APECijtt+β8LANGijt+εijt

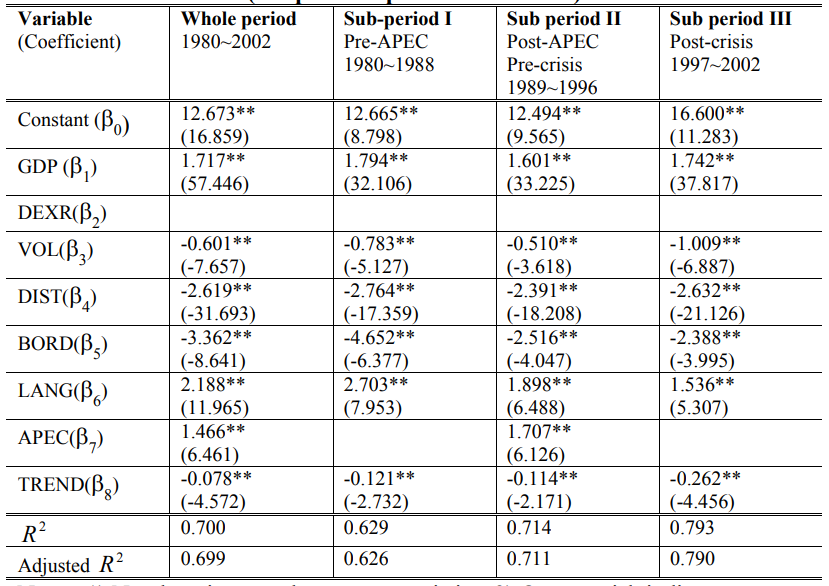

i,j stands for countries evolved in the trade. t stands for the time in the trade. Expijt is the real exports from i to j and vice versa. GDPit is the real GDP of i. VOLijt is the exchange rate volatility. VOLijt denotes the distance between country i and j. BORDijt shows whether the two countries are sharing borders. BORDijt = 1 if two countries share borders, otherwise BORDijt =0. LANGijt is the dummy variable for whether the two countries speak the same language. APEC Stands for APEC. It could be replaced by other trade associations as well such as NAFTA. The last dummy is the time trend. The regression results for the gravity model could be viewed in table 1.

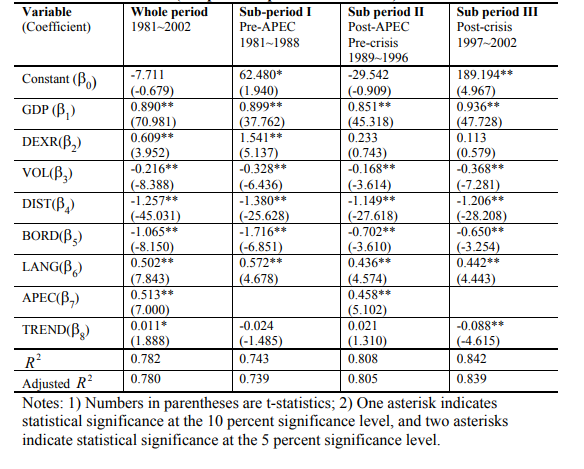

Table 1. Regression results for the Gravity model

Source credit: Baak, S. (2004)

2.2 Unilateral Exports Model

Baak (2004) has also proposed the Unilateral exports model, very similar to the Gravity Model. This two models differ at four points. First, unilateral exports model considers the exported products from one country to another as the dependent variable. Gravity Model is more concerns with the net exports between two countries. Moreover, in Unilateral exports model, only the GDP of importing country is considered as the explanatory variable. Besides, the Unilateral exports model goes a little bit further than Gravity model by including depreciation rate of the exporting country against the exchange rate of the importing country. Last, there is a fundamental assumption that small countries would be heavily dependable on imports rather than exports. As such, the formula of the Unilateral Exports Model could be expressed as follows,

Expijt =β0+β1GDPjt +β2DEXRijt+β3VOLijt+β4DISTijt+β5BORDijt +β6LANGijt+β7APECijtt+β8LANGijt+εijt

In the formula above, it could be observed that the effect of exchange rate volatility is much simplified than the Gravity model. It is because only the importing country would be taken into consideration. Big countries such as China, U.S, India and so on are recommendable to adopt this approach to measure the effect of exchange rate volatility on trade activities as the exports of small countries are quite negligible.

2.3 Exchange rate volatility

Exchange rate volatility refers to the tendency for foreign currencies to appreciate or depreciate in value. It will affect the profitability of international trade. volatility is a measurement of the amount and frequency of the changes. When a country is spending more on the international trade such as imports than its earning, it is considered as current account deficit. High exchange rate volatility usually will lead to this problem. When a country is suffering from significant trade deficit, its domestic price level will increase. It thus creates high inflationary pressure. It is usually equivalent to low currency valuation such as Zimbabwe. Terms of trade measures the difference in the import and export price. Usually a stronger term of trade means that a country tends to have stronger currency. Many researchers have discovered that a country with stronger currency tends to enjoy high political, social and economic stability. However, a country with stronger currency will make the imports cheaper than exports. It results that the competitiveness of local goods and services will be disadvantaged in the global market. Meanwhile it also widens the current account deficit. Goczek and Mycielska(2017) believe that the relationship between exchange rate volatility and merchandise trade is very much like a feed back loop. When currency appreciates, it will make the import price cheaper than exports. It means that the current account deficit will be widened. As such, imports of goods will be simulated. It results that the currency to depreciate.

III. Theoretical framework

As the aforementioned, it is indisputable that exchange rate volatility will exert a very significant impact on international trade activities but the relationship itself is very complicated. In this research, Unilateral Exports Model will be employed to figure out how exchange rate volatility may affect the trade activities by citing APEC countries as an example. The time frame will be from 1980 and 2002. During this period, APEC countries are suffering tremendously economic crisis in 1998. The formula representing trade activities under unilateral exports model is,

Expijt =β0+β1GDPjt +β2DEXRijt+β3VOLijt+β4DISTijt+β5BORDijt +β6LANGijt+β7APECijtt+β8LANGijt+εijt

The reason for selecting this model is that it is simple by removing complicated bilateral or multilateral factors. It only concerns about export activity from one country to another. Therefore, the results collected will be more straightforward. In order to understand the influence of exchange rate volatility on Expijt, the very first step is to calculate each independent variable in the equation above.

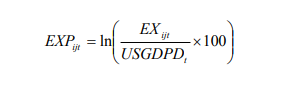

Real export

First, the real export from country i to country j in the unilateral export model is denoted as follows,

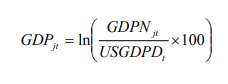

Real GDP

EXijt denotes the nominal export and USGDPDt is the U.S GDP deflator.

Second, Real GDP is given by

GDPNjt is the nominal GDP of country j.

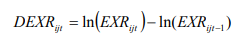

Depreciation Rate

Depreciation rate of real bilateral exchange rate is given by

EXRijt is the real exchange rate.

Real exchange rate volatility

Currently, there are still no specific formula to calculate the real exchange rate volatility, the most authoritative one is proposed by Sercu and Uppal (2006) as follows,

LEXRijk is the natural algorithm of real monthly bilateral exchange rate EXRijt which is the real exchange rate. LEXRij Bar represents the annual average of LEXRijk. The value of this formula will produce convincing result to reflect Real exchange rate volatility status of a country. This table below reflects how exchange rate volatility affects APEC countries’ bilateral or multilateral trade activities from 1981 to 2002. It could be observed from the Expijt Value that exchange rate volatility would actually bring negative impact on trade activities among APEC members.

Table 1:Regression Results for the Unilateral Exports Model(Random effects Model)

IV. Results discussion

As shown in the table, the whole period between 1981 and 2002 are split into two three major parts, namely pre-APEC period, Pre-crisis period and post-crisis period. it is because exchange rate volatility is a time-dependent factor. it is relevant and meaning to measure VOL value at different time phase. The negative sign denoted in β3VOL value might not show that cross-border trade between APEC members are discouraged. In fact, the U.S, for instance, is well-known as an economic superpower, countries such as Canada or Mexico which shares border with the U.S might be potentially disadvantaged in the trade activities. In the whole period, the value suggests that exchange rate volatility exerts a significantly negative impact on the trade activities between APEC member states between 1980 and 2002. In the unilateral export model, it could be read that the depreciation rate coefficient appears to be positive. It shows that depreciation rate will actually make exports cheaper. It will help a country to earn competitive advantage as compared with other states. So it will promote trade.

V. Conclusion

In conclusion, after conducting the secondary research, it shows that high exchange volatility will have a negative impact on trade activities. In the example of APEC member states, the coefficient of volatility is a negative value. However, further observation could also be made from the regression analysis. First, even though volatility will exert a negative impact, it is significantly weakening between 1989 and 1996 in the pre-crisis period. it shows that the negative impact of exchange rate volatility is compensated by the rapid economic development of APEC countries such as Singapore, Japan, Korea and so on. However, when the Asian financial crisis erupted, the negative impact of exchange rate volatility became very significant again. From the formula of unilateral export model, it is not very difficult to discover that the export or trade activities is dependent on my factors. Exchange rate volatility is just one of them. It is very interesting to discover that the Language factor also denotes a negative value. In other words, countries which speaking the same languages might not be a desirable factor to promote trade activities. As the aforementioned, if a country has stronger presence in the region such as the U.S, neighboring country may not be advantaged in the trading activities.

One potential limitation of this research is that the data is very obsolete. Secondary research is based on a paper published in 2002. As the aforementioned, the impact of exchange rate volatility may be subject to a feedback loop. More updated data should be collected in the future research. Moreover, the observations should not only be narrowed within one region. The impact of exchange rate volatility on trade activities should be investigated in a global context. There are more meaningful areas to be investigated. For instance, how exchange rate volatility may be a significant factor to trade during crisis and when it becomes insignificant.

Reference

Baak, S. (2004). Exchange rate volatility and trade among the Asia Pacific countries.

Goczek, L., & Mycielska, D. (2017). Exchange Rate Volatility and Exports in the run-up to the EMU accession. National Bank of Poland Education & Publishing Department.

Hall, S., Hondroyiannis, G., Swamy, P. A. V. B., Tavlas, G., & Ulan, M. (2010). Exchange-rate volatility and export performance: Do emerging market economies resemble industrial countries or other developing countries?. Economic Modelling, 27(6), 1514-1521.

McKenzie, M. D. (1998). The impact of exchange rate volatility on Australian trade flows. Journal of International Financial Markets, Institutions and Money, 8(1), 21-38.

Ozturk, I. (2006). Exchange rate volatility and trade: a literature survey. International Journal of Applied Econometrics and Qualitative Studies, 3(1), 85-102.

Sercu, P., & Uppal, R. (2006).