By XXX

I. Abstract

Linde and Pescatori (2017) provide strong criticism on literature in regards to raising export taxes to promote domestic economic activities in the U.S. During the past decades, many researchers have pointed out that the potential economic risks that local companies are outsourcing major parts of their production to other countries, especially developing countries such as China or India. It is true that the production cost would decrease remarkably but it would adversely affect the U.S domestic economic growth and result in significant job loss. Even worse, the Office of the U.S Trade Representative(USTR) reports that the policies of China’s central government in regards to technology transfer and intellectual property violation harms the U.S economy very tremendously. In this context, many economists view U.S Government’s increase in tax as a form of economic retaliation. The outcome of imposing significant tariffs may lead to trade war between China and the U.S. However, Linde and Pescatori state that many of the products produced by U.S manufacturers in a foreign country are actually contributing to the U.S economy. If the U.S government imposes tariff indiscriminately, it would equally harm the U.S economy. Auerbach et al (2017) have proposed two tax reform strategies to address this problem, including the destination-based-cash-flow tax and border adjustment tax (BAT). Some economists believe that BATs or other VAT-payroll subsidy equivalents are rather protectionalist measures. The problem of this literature that macro-economic effects of BATs are not discovered at length. Recent macroeconomic literature does not concentrate on the effect of changes in terms of tariff imposed as displayed in the empirical macro-economic model. Linde and Pescatori (2017) points out that the effects of tariffs on imports and exports could still be influenced by the Lerner symmetry model(Lerner, 1936).

In section II, the trade literature would be reviewed. In section III, theoretical framework, methodology and data would be presented. In section IV, the impacts of tariffs on imports from China would be especially discussed. Section V would be the concluding remarks.

II. Literature Review

2.1 BAT

这部分因为上传word文字网页复发识别符号所以直接上传文本截图了希望客户理解

这部分因为上传word文字网页复发识别符号所以直接上传文本截图了希望客户理解

2.2 DBCFT

A group of researchers have systematically evaluated destination-based cash flow taxation(DBCFT) as an effective tariff approach on imported goods. As the aforementioned, it is not very easy to issue tariff on imports indiscriminately as the tax cost might go back to the U.S producers. It is because many of them have shifted their production lines overseas(Auerbach, Devereux, Keen and Vella, 2017). The Ways and Means Committee of the U.S House of Representatives has published a blueprint document to point out that DBCFT is “a better way for tax reform”. According to the report of Auerbach (2017), the DBCFT includes two major components. One component is called “cash flow element”. Cash flow would give relief to all expenditure including capital expenditure and tax revenue. The other component is “Destination-based element”. In other words, only imports are taxed. Exported goods are excluded from value added tax (VAT). In their report, researchers manage to describe DBCFT, explain how it works and propose feasible challenges of implementation.

With respect to cash flow taxation, the Meade Committee suggests that it could be mainly categorized into two groups. One is called R-based taxation. The taxation scheme is based on real inflow and real outflow of goods and services. The other cash flow taxation is called R+F-based taxation. Besides inflows and outflows, financial assets and liabilities are also taxable. The table below shows an example of Real plus financial taxation approach. Assume that there is a two-period investment in a bilateral trade. The total cost is 100 in period 1. Tax rate is 20%. Net interest rate is 10%. As shown in the table, there would be a -20 cash flow tax. In period 2, the invest is able to make a return. The break even point occurs when the rate of return equals the discount rate of net present value. It generate 22 tax liability in Period 2. The net NPV is zero. It shows that economic rent before and after taxation is both zero. It shows that tax is falling on the economic rent as a whole.

Table 1: Illustration of Real plus Financial Taxation

2.3 Destination-based tax

Many researchers have pointed that the above-mentioned tax may lose its neutrality when tax rate keeps fluctuating. A falling in the tax rate would result a surge in investment. Thus , in this way, the cost is compensated at a higher tax rate(Devereux&Feria, 2014). So it means that alternative tax approach should be considered with respect imports tariff. So far, destination-based tax also remains favorable among policy makers. This tax approach is closely related to how a country determines the component of import and export tax based on its own jurisdiction. For instance, the destination-based tax could be implemented in a way that imports are taxed but exported goods and services are excluded. As compared with DBCFT and BAT, destination-based tax concerns more about the income and expenses of a company. Income of the goods and services is subject to the tariff imposed in the destination country. Expenses includes labor, tax relief in the country of origin.

III. Theoretical Model

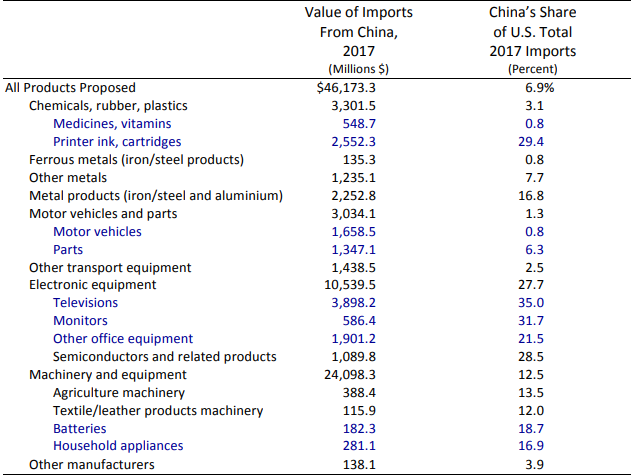

After closely assessing various model of import tax, it seems that BAT is highly applicable in the U.S context. As shown in table 2, many U.S products are highly subject to BAT. Among all the areas, electronic equipment remains the largest portion. In fact, in order to save production cost, many local electronic firms are moving their production in other country such as China. It is because the labor cost, land cost, raw materials and so on are much cheaper than the U.S. it is also the major reason why BAT is more applicable than the rest models.

Table 2: U.S products subject to BAT

Source Credit: Census data

Assume that China and U.S has a stable exchange rate on a one-for-on basis. First, as show in panel A, if both China and U.S has a same BAT rate at 10%. The net profits of a U.S firm is thus 180. It shows that the company’s business will not be significantly affected. However, as the labor cost and other associated costs are very low, a U.S company may still outsource a significant portion of its production activities in China. However, when China increase the import tax to 25%, the company’s after-tax profit is going to drop to 157.5. it shows that a company’s net profit margins will significantly decline. When the BAT tax increases, it offers the U.S company incentive to shift business operations back to the U.S. As shown in Panel, shifting production will help a company to reclaim a profit of 180. It means that the total after-tax liability is about 15.

Panel A

U.S |

China |

Total |

|

Tax rate |

10% |

10% |

|

Labor cost |

60 |

0 |

60 |

Other costs |

50 |

0 |

50 |

Sales |

150 |

150 |

300 |

BAT Tax base |

50 |

150 |

200 |

BAT Charge |

5 |

15 |

20 |

Net profit |

45 |

135 |

180 |

Panel B

U.S |

China |

Total |

|

Tax rate |

10% |

25% |

|

Labor cost |

60 |

0 |

60 |

Other costs |

50 |

0 |

40 |

Sales |

150 |

150 |

300 |

BAT Tax base |

50 |

150 |

200 |

BAT Charge |

5 |

37.5 |

42.5 |

Net profit |

45 |

112.5 |

157.5 |

Panel A

U.S |

China |

Total |

|

Tax rate |

10% |

25% |

|

Labor cost |

0 |

60 |

60 |

Other costs |

0 |

40 |

40 |

Sales |

150 |

150 |

300 |

BAT Tax base |

150 |

50 |

200 |

BAT Charge |

15 |

12.5 |

27.5 |

Net profit |

135 |

37.5 |

172.5&l |